HSBC UK has confirmed that the cooling off period for its gambling block feature has been extended from 24 hours to 72 hours.

The announcement follows the UK Gambling Commission’s (UKGC) revelation that there has been a month-on-month increase of 29% in gross gambling yield (GGY) and a 7% increase in active accounts.

Maxine Pritchard, Head of Financial Inclusion and Vulnerability at HSBC UK said: “This is a challenging time for many of our customers, with some not working and perhaps facing financial difficulty. By increasing the restriction to 72 hours, this will help give our customers time to pause when they are tempted to return to gambling.

“We are always looking for new ways to support our customers and make it easier for them to manage their finances. Customer feedback on our gambling control showed us there was more we could do to help and we’ve worked closely with them and with GamCare to design the solution.”

Once it is switched on, HSBC’s self-restriction tool prohibits customers from making gambling payments on their accounts.

The tool also automatically declines any gambling transactions for three days in order to help those experiencing problems with gambling to better control their spending habits.

It is available to both USBC UK and First Direct customers with an active debit card, and can be switched on via the bank’s mobile app, telephone banking or by going into a local branch.

In addition, HSBC and First Direct maintain specialist support teams to assist vulnerable customers who may be at risk of financial harm due to gambling, and can also refer customers to external organisations if felt necessary.

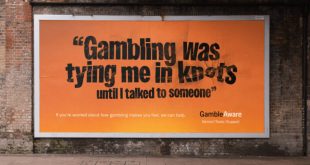

Anna Hemmings, CEO of GamCare, added: “The ability to block gambling transactions through your bank card or app is an important tool for those struggling with their gambling, and is ideally used together with other practical tools such as self-exclusion, blocking software, and specialist support around the issue – as we have recently emphasised through our ‘TalkBanStop’ partnership and campaign.

“The University of Bristol Personal Finance Research Centre has also highlighted that ‘positive friction’ such as a cooling off period is important for the success of blocks, as this prevents them being turned off in the event of urges to gamble. GamCare is pleased to see HSBC UK and first direct take this positive step to support their customers.”

GamCare recently launched its 12 month ‘TalkBanStop’ imitative along with GamBan and GambleAware, which offers free tools to support problem gamblers in managing their betting behaviour

In addition to extending cool off periods, responsible gambling advocates have also called for betting operators to allow their customers greater flexibility in setting deposit limits.