Barclays has confirmed that it will become the first UK high-street bank to integrate a ‘gambling-block’ component across its customer-facing digital platforms.

Updating the media, Barclays informs that the gambling-block feature will allow customers to turn-off engagements/transactions with all gambling-related properties – retail bookmakers, casinos, racetracks, lottery and digital betting enterprises.

The gambling-block feature has been co-developed with citizen financial advisory the Money Advice Trust, and seeks to bring greater control and spending safeguards to Barclays customers.

Catherine McGrath, Managing Director at Barclays UK, said: “We work with a range of advisers and partners, as well as consulting with our customers, to identify how our customers’ needs are changing and what works for them.

“This new control feature is the latest new service that we have introduced in the Barclays Mobile Banking app that aims to give all of our customers a better way to manage their money in a simple, secure and effective way.”

Barclays further informs that it has worked with Money and Mental Health Policy Institute set up by consumer champion Martin Lewis of MoneySavingExpert, to help identify customer profiles and risky retail segments.

Martin Lewis of MoneySavingExpert, the founder and chair of the Money and Mental Health Policy Institute, said: “Mental health and debt is a marriage made in hell. Many with mental health issues struggle to control their spending – whether through gambling, shopping or premium phone lines – and I commonly hear from people with thousands of pounds of debt as a result.

“I want to applaud Barclays for being the first major bank to sit up, take note and act. I believe it will make a real difference to people’s lives and I hope the other banks will follow suit.”

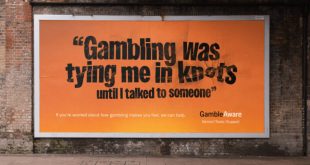

Commenting on the news, Marc Etches, Chief Executive of GambleAware, welcomed the initiative: “There are 340,000 problem gamblers in Britain and a further 1.7 million at risk, and initiatives like this can play an important role in helping to reduce gambling-related harms.

“There are no limits to stakes and prizes for online gambling, and credit cards are allowed so it is important to make it easier for people to control their spending.”