Allwyn confirms recent news speculation, disclosing this morning that it has agreed to merge with SPAC vehicle Cohn Robbins Holdings Corp (CRHC)– a transaction that will see the multinational lottery operator list on the New York Stock Exchange (NYSE).

Issuing a joint statement this morning, Allwyn and CRHC dealmakers pursue an NYSE listing that will value the lottery group at $9.3 billion (€8.25bn) – representing a deal multiplier of 11X on FY2022 expected EBITDA.

The NYSE was deemed the ‘premier platform’ for the “next evolution of Allwyn” that will secure enhanced capital access to expand its business through digitisation, M&A and scaling the group to win more licensed gambling tenders.

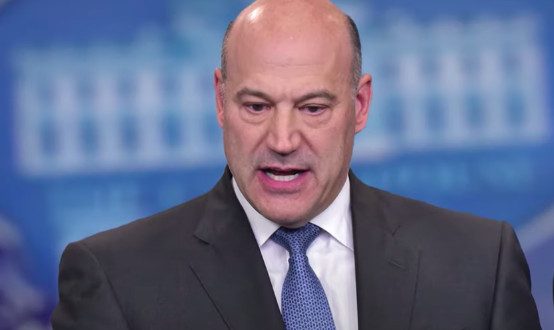

Listing sponsor CRHC is the blank cheque company of former Goldman Sachs President and COO Gary Cohn and Clifton S Robbins, the founder of activist investment fund Blue Harbour.

NYSE-listed CRHC has raised $828 million cash to fund the transaction. In addition, the SPAC will commit to a ‘PIPE Investment’ to purchase $350 million of securities of the combined enterprise – a transaction that will be open to international investors, of which $50 million will be funded by CRHC.

“We believe that Allwyn is the right Company, in the right industry, at the right time and with the right leadership team. We are excited by the growth opportunities the Company has ahead of it, and we look forward to providing our support.” – read a joint statement by Cohn and Robbins.

“We are very pleased to be bringing this transaction to Cohn Robbins shareholders in an innovative way and at an attractive valuation.”

The board of Allwyn outlined its full support of an NYSE-listing, allowing the lottery group to expand and diversify beyond European markets, to become the dominant player of the $300 billion global lotteries marketplace.

“Allwyn operates lotteries in Austria, the Czech Republic, Greece, Cyprus and Italy, and forecasts approximately $810 million (€710 million) in Adjusted EBITDA from approximately $1.7 billion (€1.5 billion) in net gaming revenue in 2022.” – Allwyn cited in its overview.

Expanding its investment capacity, Allwyn outlined that it would aim to optimise and scale its best-in-class European operations, technologies and systems and to bid for lottery tenders in North America and emerging markets.

Robert Chvatal, Chief Executive Officer of Allwyn, stated, “It is an opportune time for Allwyn to take this exciting step. Jurisdictions in Europe and North America should have higher expectations for the innovations their lotteries can deliver.

“We look forward to applying our experience in developing market-specific, culturally-attuned lottery entertainment to new customers and geographies as an NYSE-listed company.”

Of significance to its valuation and commercial development, Allwyn has stated its intent to win the UK government’s Fourth National Lottery Competition that will be decided in 2022.

Allwyn’s bid to replace Camelot UK as the operating steward of the National Lottery is led UK Chairman Sir Keith Mills who commented – “The announcement of Allwyn Entertainment’s intention to become a publicly-listed company on the New York Stock Exchange is an important milestone for our parent company. It is a significant endorsement of Allwyn’s ability to increase lottery sales around the world by making them more entertaining, innovative, and appealing to their customers.”

“It’s exciting to see our parent company’s appetite for growth and the desire to bring lottery expertise to new corners of the world. And whilst we have already submitted our bid for the Fourth National Lottery Licence, this partnership only makes our proposition stronger”.