Our typical investment is “not well-understood” by most people, said Waterhouse VC Chief Investment Officer Tom Waterhouse, who outlined how his fund invests in businesses solving key problems for both the operator and the customer.

He told SBC Americas why the fund is looking at high-growth opportunities in very specific areas, including companies within the emerging Metaverse space and those providing a critical B2B service with a “defensible operational moat”.

SBC: Hi Tom, thank you for talking to us. First of all, you were Australia’s largest bookmaker before launching the country’s fastest growing online sports betting business. Then you were CEO of William Hill Australia. How did all these experiences prepare you for setting up an investment fund?

TW: We set up the fund to leverage off my past experience, contacts, expertise and our existing team of technical and digital talent.

While many investors may understand the sector and can analyse the large B2C operators, we believe we have an edge considering our deep knowledge of the suppliers to the industry.

This, combined with the opening up of the US market in 2018, were key reasons why I started Waterhouse VC, which now invests globally across publicly listed and private businesses in the gaming and wagering sector.

SBC: What sort of businesses are you typically looking to invest in? And why should businesses reach out to you today?

TW: We invest across three themes:

- Dominant scale operators in regulated markets (such as Flutter)

- Business-to-business (B2B) services to wagering operators (such as BetMakers)

- Convergence with the wagering industry, such as video gaming, tokenisation, and media (such as PlayUp).

From my experience as an industry CEO and prior experiences starting businesses in the sector, I realised that there could be hundreds of services in the product pipeline for B2C operators. We want to invest in businesses that are good enough to get onto that product pipeline and help them get to the top.

Businesses should reach out to us if they are driven to dominate their niche, particularly if they are B2B service providers. Companies can contact us at [email protected].

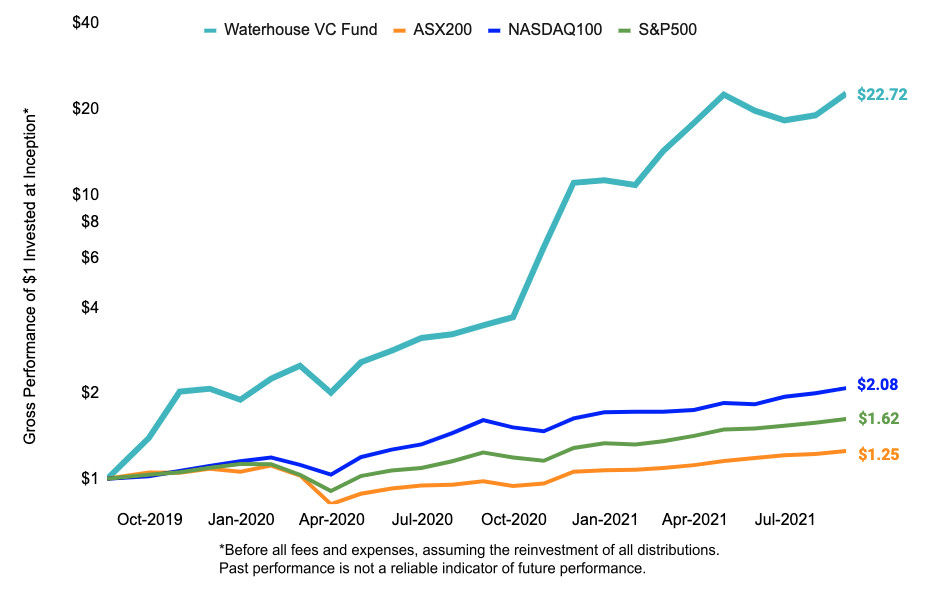

SBC: Why has Waterhouse VC recorded such strong performance, and could you highlight some of the fund’s biggest success stories to date?

TW: Sure. We’ve benefited from the continued legalisation of online sports betting in the US and are confident that many of our portfolio holdings will play a significant role in the US ecosystem.

Two of our B2B investments are: BetMakers (ASX:BET) and Aspire Global (SS:ASPIRE).

BetMakers compiles 100s of data feeds from racing jurisdictions around the world and supplies them to bookies via a single integration through their Global Racing Network. They are essentially a middleman between racing authorities and bookmakers. They also have a complimentary Global Tote business and Betting Services business. They are an integral part of wagering on global horse racing.

Aspire Global offers B2B products and solutions for launching and operating online casinos and sportsbooks. They can handle all aspects of running a gaming site, making the company a ‘one-stop-shop’. Aspire offers products for the customer-facing aspects of a gaming site like casino, sports betting and bingo platforms, plus outsourcing solutions for ‘back-office’ operations like payments, customer support, compliance, VIP management, CRM services, and data analysis.

We expect the company to announce larger customers for its platform solution in the U.S. and Europe, and to launch new products to existing partners.

SBC: What’s the most important thing(s) you look for in a prospective investment?

TW: Our typical investment is: B2B, not well-understood by most people, relatively small, solving a key problem for the operator or the customer.

We target businesses that provide a critical service with a defensible operational moat. We look for companies well-positioned to benefit from high growth within a specific area of gaming and wagering.

SBC: What are you most excited about in the gaming and wagering space? Where are the biggest opportunities for investment?

TW: The market is very focused on the US at the moment but perhaps the biggest space of all is the Metaverse, so gambling inside digital ecosystems like video games and virtual worlds. This could be the biggest market of all and most people haven’t woken up to this yet and we are looking to be at the forefront of that change.

We are excited by the continued opening up of the US market and the emergence of the Metaverse. We believe that both these areas will have significantly higher growth rates than more mature wagering and gaming markets. Our focus will continue to be finding key suppliers that can service those markets and then assisting these businesses in reaching their full potential.

SBC: As you mentioned, you have developed multiple companies and brands in the sector for a number of years. Can you give us a small overview of the different things you are currently working on?

TW: My personal focus is Waterhouse VC, that is where I am spending most of my time. Other companies under my brand that are currently in the market include a direct-to-consumer mobile app WaterhouseTips.com, as well as my technology consultancy Waterhouse Technology.