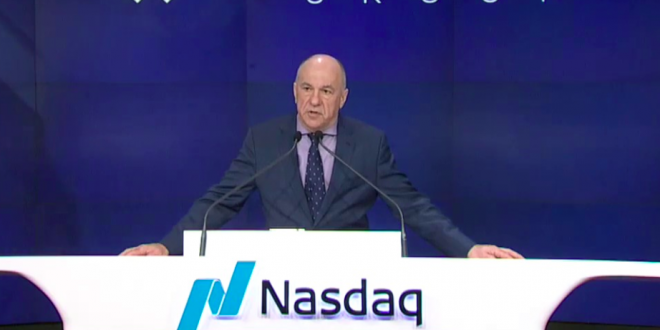

Ringing the opening bell of New York’s Nasdaq Exchange on Tuesday 14 January, Newgioco Group Chairman and CEO Michele Ciavarella stated that the sports betting group had begun its new life as a fully established Italian-American enterprise.

The New York listing sees Ciavarella complete a two-year project transforming Newgioco’s business lines and restructuring the firm’s executive team, targeting rapid growth as a ‘full suite’ systems supplier for the US’ new sports betting incumbents

A heritage brand within Italian gambling, Newgioco operates +2000 betting point network within its home market, in which incumbents have been forced to undertake significant adjustments accommodating for changing regulatory dynamics.

Newgioco’s Italian disruption coincided with the 2018 federal repeal of PASPA, an opportunity that Ciavarella would not miss.

“The listing of our common stock on the Nasdaq is a major milestone for the company and the result of approximately twenty years of dedicated business development in the regulated leisure betting industry,” said Ciavarella as part of Newgioco’s Nasdaq IPO statement.

Repositioning the business as a US sportsbook supplier, in 2019 a new Newgioco executive team would launch the firm’s ‘ELYS platform’, securing its first US contracts with the Montana-based Chippewa Cree Tribe ‘Winz Casino’ and Washington DC’s Grand Central casino.

Prior to its Nasdaq listing, Newgioco had registered its US operations as a limited securities ‘over-the-counter’ enterprise, a necessary solution for the company to find its US footing, but one which limited its overall growth capacity.

Speaking to US Media, Ciavarella admitted that Newgioco brokers had a very difficult time persuading folks to invest in the OTC registered firm: “The Nasdaq has changed that whole element,” it added. “To be on such a global exchange puts the company in a different classification of reporting. Basically, that changes the dynamic of how investors look at Newgioco as a potential investment opportunity.”

Moving forward, Ciavarella believes the improved transparency will be beneficial in more ways than one, adding: “Being a fully transparent company is important when we are meeting with some of the larger institutional commercial casino operators and also the regulators, particularly in regards to the US market which is opening up for us.”