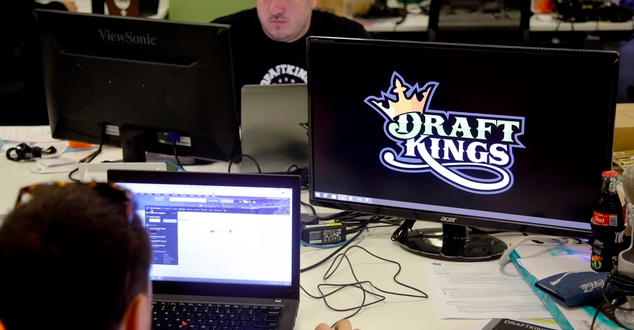

Amid global COVID-19 disruptions, US analysts are monitoring DraftKings developments closely as the DFS and sportsbook operator pursues its 2020 agenda of listing on the US Nasdaq exchange this April.

This morning, the firm published the following statement which read: “We are pleased that our registration statement was declared effective by the U.S. Securities and Exchange Commission this morning, which brings us another step closer to our goal of becoming a public company in April.”

DraftKings has entered its final phase of merging with betting systems provider SBTech to form a new $3 billion enterprise backed by LA sports and entertainment private equity fund Diamond Eagle Acquisition Corp.

The combination, which will form ‘DraftKings INC’, has been led by Hollywood magnates Harry E Sloan and Jeff Sagansky spearheading Diamond Eagle’s reverse takeover bid.

Finalising its deal, Diamond Eagle – a PE fund which trades on the US Nasdaq – is scheduled to host its shareholder vote on 23 April, green-lighting the ambitious three-way tie-up.

Merger prospects will see DraftKings accelerate its ‘ leading B2C’ profile across all regulated market states, powered by SBTech technology systems to form ‘the first vertically integrated pure-play sports betting and online gaming company based in the United States’.

DraftKings’ aggressive masterplan will be funded by Diamond Eagle securing $500 million in working capital to generate funds through a critical 2020 IPO.

Nevertheless, Sloan and Sagansky’s playbook will be tested by the dire conditions facing all market investors navigating COVID-19 headwinds, should DraftKings maintain its April IPO stance.

With all US pro leagues suspending their schedules under lockdown, analysts will likely question whether a DraftKings IPO soothes investor appetite amid dire daily economic forecasts, in which all US companies seek to recapitalise their share prices escaping bear market conditions.

Diamond Eagle has pursued its ambitious tie-up since December 2019, a reverse takeover branded as a ‘Christmas Cracker’ for US sports and entertainment investors. Nevertheless, COVID-19 realities and dire circumstances may see DraftKings planned April IPO become an ‘Easter Turkey’.